Forms of Business Ownership

Forms of Business Ownership. Introduction. Sole Proprietorship. “a business owned by one person who is subject to claims of creditors” Advantages: 1) ease of formation 2) retention of profits 3) tax advantages 4) control of decisions 5) flexibility

Share Presentation

Embed Code

Link

Download Presentation

- service industries

- new businesses

- corporation

- calculated risk takers

- joint profit

- special trade construction

alida + Follow

Download Presentation

Forms of Business Ownership

An Image/Link below is provided (as is) to download presentation Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author. Content is provided to you AS IS for your information and personal use only. Download presentation by click this link. While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server. During download, if you can't get a presentation, the file might be deleted by the publisher.

Presentation Transcript

- Forms of Business Ownership Introduction

- Sole Proprietorship • “a business owned by one person who is subject to claims of creditors” • Advantages: 1) ease of formation 2) retention of profits 3) tax advantages 4) control of decisions 5) flexibility 6) fewer gov’t. regulations 7) pride of ownership

- Sole Proprietorship (cont’d) • Disadvantages: 1) unlimited liability 2) limited capital 3) unstable business life/lack of continuity 4) limited operating/ mgt. skills 5) hiring employees

- Partnership • “the voluntary association of two or more people who have combined their resources to carry on as co-owners of a lawful enterprise for their joint profit”

- Advantages of Partnership • 1) ease of formation • 2) complementary skills • 3) access to capital • 4) tax advantages • 5) retention of profits • 6) group decision making • 7) minimal governmental control

- Disadvantages of Partnership • 1) unlimited liability • 2) uncertain duration • 3) conflict • 4) dissolution

- Types of Partnership • 1) active/general partner • 2) secret partner • 3) silent partner • 4) dormant partner • 5) limited partner

- Selecting a Partner • “Don’t go into business with a friend because you will likely lose that friend” • Characteristics of a “good” partner

- Partnership Agreements • advisable even if the partners are friends • can delineate the responsibilities of each partner and protect everyone with an interest in the business • Uniform Partnership Act • Articles of Partnership

- Articles of Partnership • should address the following: • 1) legal name of the partnership • 2) nature of the business • 3) duration of the partnership • 4) contributions • 5) sales, loans and leases • 6) withdrawals and salaries • 7) responsibility and authority • 8) dissolution • 9) arbitration

- Corporation • “an artificial being, invisible, intangible, and existing only in contemplation of law; an entity that is something that has a distinct existence separate and apart from the existence of its individual members”

- Corporation (cont’d) • composed of: shareholders/stockholders directors officers

- Advantages of Corporations • 1) limited liability • 2) transfer of ownership • 3) stability/perpetual life • 4) acquisition of capital • 5) skilled managers • 6) stockholders as customers

- Disadvantages of Corporations • 1) taxes • 2) rigidity • 3) shared ownership • 4) regulations

- Types of Corporations • 1) domestic • 2) foreign • 3) alien • 4) publicly held/open • 5) closely held/closed

- “S” Corporations • provided for in subchapter S of the tax code • created especially for small business • taxed like partnerships

- “S” Corporations (cont’d) • Advantages: • 1) lower “current” income tax • 2) exemption from the corporate alternative minimum tax • 3) flexibility in using different accounting methods

- “S” Corporations (cont’d) • Disadvantages: • 1) multistate “S” corporations • 2) banks may be reluctant to lend to “S” corporations that distribute all their earnings • 3) rigid restrictions

- Restrictions of “S” Corporations: 1) limit of 75 stockholders 2) stockholders must be individuals, estates, or certain trusts 3) no corporations, partnerships, or nonresident aliens can be stockholders 3) only one class of outstanding stock 4) the firm must be a domestic corporation 5) certain states do not permit “S” corp. Status 6) all stockholders must agree to the decision for form an S-corporation 7) company cannot be an ineligible corporation

- Incorporating a Small Business • legal counsel is recommended • most states have specific standards • Articles of Incorporation

- Articles of Incorporation • At a minimum must include: • Corporate name • Location of the company • Purpose of the company • Duration • Names and addresses of incorporators • Amount and type of stock to be issued • Capital required at time of incorporation

- Articles of Incorporation (cont’d) • Provisions for stockholders preemptive rights • Names and addresses of initial directors and officers • Provisions for regulation of the affairs of the company • Right to amend, alter, or repeal corporate provisions • Bylaws

- Limited Liability Company • “combines aspects of partnerships with the limited liability of a corporation” • new form of business ownership • approved in all states • owners are known as members

- Limited Liability Company (cont’d) • Advantages: • 1) corporate-like limited liability and asset protection • 2) flexibility of partnership • 3) no significant requirements • 4) tax status of partnership

- Joint Venture • “an agreement between two or more groups to form a business entity in order to achieve a specific goal or to operate for a specific period of time” (Pride, Hughes, Kapoor 2005) - acts like a general partnership, but is clearly for a limited period of time or a single project

- Small Business • “ a business which is independently owned and operated and is not dominant in its field of operations” • 1) quantitative criteria • 2) qualitative criteria

- Quantitative Criteria • number of employees • dollar sales volume

- Qualitative Criteria • Actively managed by its owner(s) • Highly personalized • Largely local in its area of operations • Largely dependent on internal sources of capital to finance its growth • The business is not a major force (dominant) in the particular industry

- Small Business Adm. (SBA) Guidelines • Manufacturing: maximum of 500 – 1500 employees • Wholesaling: maximum of 100 employees • Retailing: yearly sales/receipts from $6million - $24.5 million • Mining: maximum of 500 employees

- SBA Guidelines (cont’d) • General Construction: average annual receipts from $12 million- $28.5 million • Special Trade Construction: annual sales up to $12 million • Agriculture: maximum annual receipts of $.75 million - $5 million • Services: maximum annual receipts ranging from $6 million - $29 million

- Small Business Sector • Since 1995, the number of small businesses in the United States has increased 49% • Over 70% of new businesses can be expected to fail within their first 5 years…..the primary reason is mismanagement

- Small Business Industries • Distribution Industries: concerned with the movement of goods from producers to consumers (33%) • Service Industries: (48%) • 75% nonfinancial services • 8% financial services • Production Industries: (19%)

- Characteristics of Small Business Owners • Motivated to achieve • Calculated risk takers • Self-confident • Orderly • Willing to work long hours • Healthy • Committed • Antistatus • Superior conceptual ability • Optimistic

- Reasons Why Small Businesses Fail • 1) capital: money-related problems • 2) management: lack the skill to manage money, time, personnel, and inventory • 3) planning: overexpansion

Forms of Business Ownership

Forms of Business Ownership. Making Informed Decisions. Sole Proprietorship General Partnership Limited Partnership Limited Liability Partnership. Limited Liability Company C Corporation S Corporation Franchise. Entrepreneurial Forms of Conducting Business.

554 views • 20 slides

Forms of Business Ownership

Forms of Business Ownership. By: Courtney Boutarfa. Sole Proprietorship. A business owned and managed by one person, the proprietor. . Advantages. Disadvantages. Owner may lack the necessary skills and abilities to run the business Owner might lack capital

262 views • 0 slides

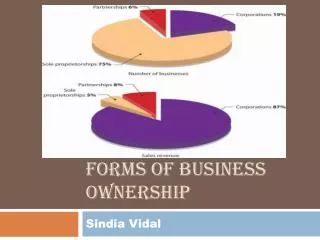

Forms of business Ownership

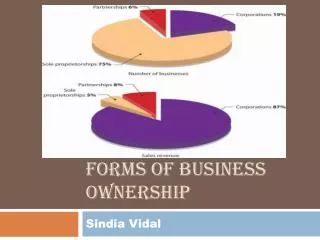

Forms of business Ownership . Sindia Vidal . Sole proprietorship. One owner This is a type of ownership where an individual wants to work and make his decisions independently. . Buddy.

375 views • 17 slides

Forms of Business Ownership

Yoong Woo. Forms of Business Ownership. Sole Proprietorship. Sole Proprietorship. Individuals who want to work and make decisions independently Little government regulation Great risk for the owner. Partnership. Partnership. Owned and controlled by two or more people

268 views • 14 slides

forms of business ownership

proprietorship. forms of business ownership. partnership. corporation. proprietorship. [ characteristics] . DEFINITION : A business owned and managed by one person, also known as a sole proprietorship.

442 views • 23 slides

Forms of Business Ownership

Forms of Business Ownership. Choosing a Form of Ownership. There is no one “best” form of ownership. The best form of ownership depends on an entrepreneur’s particular situation.

580 views • 26 slides

Forms of Business Ownership

Forms of Business Ownership. By: Emmanuel Juarez. Sole Proprietorship . A sole proprietorship is a business owned and operated by one individual Disadvantages:

184 views • 9 slides

Forms of business ownership

Forms of business ownership. Sole proprietorship. Advantages. Pride of personal ownership Right to decide about distribution of any profits Owner makes all business decisions Opportunity to be one’s own boss Owner is manager. disAdvantages. Unlimited liability

254 views • 10 slides

Forms of Business Ownership

Forms of Business Ownership. Leslie Lum. Bellevue Community College. Categories of Companies. Advantages Easy to set up Control Retain all profits Flexibility Privacy Pension benefits. Disadvantages Typically small business Limited financial resources Lack of critical mass

265 views • 16 slides

Forms of Business Ownership

By Gustavo Lucio. Forms of Business Ownership. Sole Proprietorship. This type of ownership is for people who want to make all of their business decisions independently. This type of ownership has little regulation from the government.

329 views • 10 slides

Forms of business ownership

Forms of business ownership. Sole proprietor An individual owns & operates the business Partnership A group of people own and operate Corporation Stockholders own the corporation Stockholders elect board of directors Directors hire management Stockholders have limited liability.

294 views • 14 slides

Forms of Business Ownership

Forms of Business Ownership. Pros and Cons. Sole Proprietorship. Pros Simple to create Least expensive to create You keep ALL profits You make ALL decisions Very little government regulation Easy to close. Cons Unlimited personal liability (you pay ALL expenses)

152 views • 4 slides

Forms of Business Ownership

Forms of Business Ownership. Business 40 Week 4 Carole K. Meagher 9 February, 2005. Agenda. Roll call, introductions, project ideas DVD Article analysis Before you leave tonight… I need a roster with your group and project idea Week 4 Lead-in. “Joe to Go”. Cluster into your groups

642 views • 57 slides

Forms of Business Ownership

Forms of Business Ownership. MAM1010. Warm-up. Discuss the following scenarios with a partner: Rachel and Terry would like to open up a McDonald’s next month. Can they open up a McDonald’s without any problems?Why or why not?

500 views • 18 slides

Forms of Business Ownership

Forms of Business Ownership. Chapter 7. Sole Proprietorship : business firm with one owner and accounts for nearly 75% of all the nation’s business firms. Advantages : pg 129-130 1. Freedom to enter and exit the market easily 2. Freedom from outside control 3. Freedom to retain information

796 views • 15 slides

Forms of Business Ownership

Forms of Business Ownership. It’s just paper. All I own is a pickup truck and a little Walmart stock. ……………………………….. Sam Walton. Evaluation Criteria. Tax consideration Liability exposure Start-up and future capital requirement Control Managerial ability Business goals

382 views • 24 slides

Forms of Business Ownership

CHAPTER 5. Forms of Business Ownership. Choosing a Form of Ownership. There is no one “best” form of ownership. The best form of ownership depends on an entrepreneur’s particular situation.

475 views • 23 slides

Forms of Business Ownership

Forms of Business Ownership. Sole Proprietorship Partnership Corporations. Forms of Ownership Comparison. Sole Proprietorships. Oldest and Most Common dated by to colonial times Owner and Managed by one individual with minimum amount of help

1.28k views • 27 slides

Forms of Business Ownership

Forms of Business Ownership. Georgia CTAE Resource Network Curriculum Office, June 2009 To accompany curriculum for the Georgia Peach State Career Pathways June 2009, Dr. Marilynn Skinner. Sole Proprietorship.

218 views • 10 slides

Forms of Business Ownership

Forms of Business Ownership. Business Ownership. Three Common Forms. Sole Proprietorships. Partnerships. Corporations. Sole Proprietorship. Advantages. Disadvantages. Ease of establishment Self-satisfaction Privacy Tax advantages. Unlimited liability Personal pressure

380 views • 22 slides

FORMS OF BUSINESS OWNERSHIP

FORMS OF BUSINESS OWNERSHIP. SOLE TRADER. IS A PERSON THAT OWNS AND RUNS THEIR OWN BUSINESS. CHARACTERISTICS OF A SOLE TRADER. ONE PERSON PROVIDES ALL THE MONEY(Capital) ONE PERSON MAKES ALL THE DECISIONS ONE PERSON KEEPS ALL THE PROFIT. Advantages of a Sole Trader.

252 views • 21 slides

Forms of Business Ownership

Forms of Business Ownership. MAM1010. Warm-up. Discuss the following scenarios with a partner: Rachel and Terry would like to open up a McDonald’s next month. Can they open up a McDonald’s without any problems?Why or why not?

256 views • 18 slides